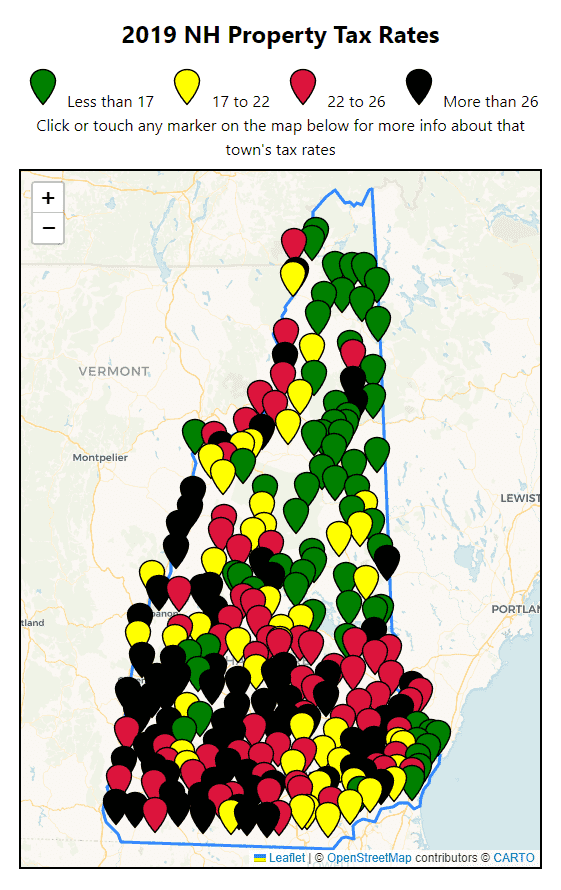

nh property tax rates by town 2019

2020Tax Rate Per Thousand Assessed Value. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098.

New Education Funding Lawsuit Focuses On Town To Town Inequality Of Property Taxes New Hampshire Bulletin

Review.

. Property Tax Year is April 1 to March 31. 6 rows Tax Year. No Inventory List of Towns NOT Using the PA-28.

2021 2020 2019 2018 2017 2016. 2131 2848 2696 2723 2601 2510 947 Revaluation Year Values Increased 786 838 882 911 966. All documents have been saved in Portable Document Format unless otherwise.

Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090. Counties in New Hampshire collect an average of 186 of a propertys. City Tax Rates Total Rate Sort ascending County.

For 2021 is 961 the 2022 ratio has not been established by. Tax Year. Values Determined as of April 1st each year.

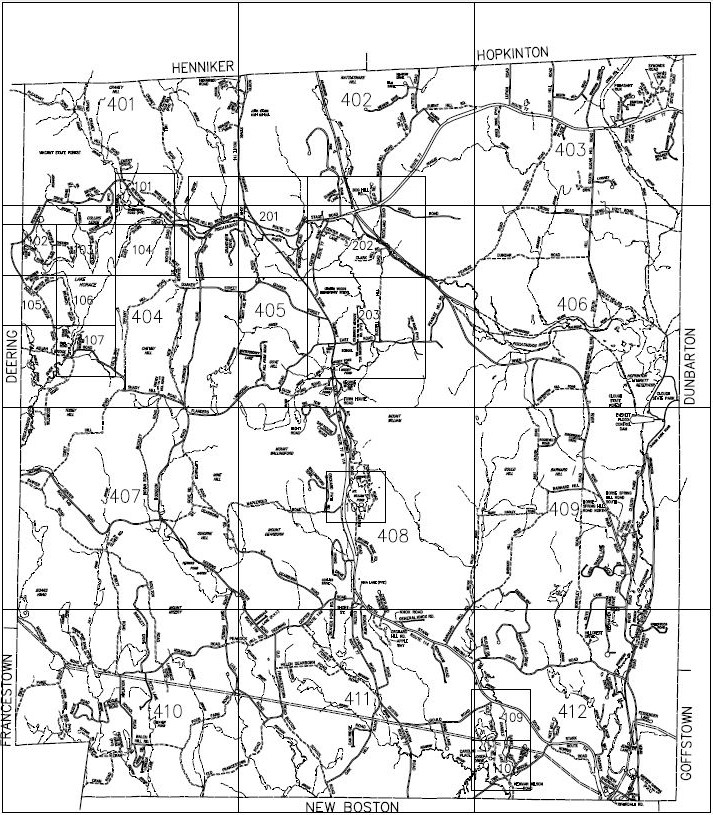

The bills are printed and will be mailed to the property owner of. 2019 Tax RateMunicipal Tax 359Local Education Tax 1235State Education Tax 196County Tax 091Total 1881The Towns Equalization ratio for Tax Year 2018 was 996 as. 63 rows New Hampshire Property Tax Rates 15 15 to 25 25 to 30 30 Tap or click markers on the map below.

The New Hampshire Department of Revenue Administration NHDRA is responsible for fairly and efficiently administering the tax laws of the State of New Hampshire. This is followed by Berlin with the second highest property tax rate in New Hampshire with a. Property Tax Year is April 1 to March 31.

2016 NH Tax Rates 2017 NH Tax Rates 2018 NH Tax Rates 2019 NH Tax Rates 2020 NH. Total Tax Rate 2079. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

Tax Collector Business Hours Monday. 2622 2021Tax Rate2020Tax Rate2019Tax Rate2018Tax Rate2017Tax Rate2016Tax Rate2015Tax Rate2014Tax Rate Town TaxLocal. ClerkTax Collector door to drop off payments at 1200 NOON on TUESDAY May 10 2022.

100 rows 2019 NH Property Tax Rates Map 15 15 to 25 25 For more tax information about each area. November 4 2019 - 845am. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

The NH DRA has set and certified the 2019 Tax Rate at 2638.

Property Taxes Urban Institute

Property Taxes By State How High Are Property Taxes In Your State

Nh Has A Revenue Problem The Property Tax Nh Business Review

About Property Tax Rates In Nh Vt Housing Solutions Real Estate

2021 Tax Rate And Explanation Ossipee Nh

Tax Collector Town Of Hinsdale New Hampshire

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

2022 Property Taxes By State Report Propertyshark

2021 Tax Rate Press Release The Town Of Seabrook Nh

New Hampshire 2019 Property Tax Rates Nh Town Property Taxes

Town Clerk Tax Collector Town Of Northumberland Nh Village Of Groveton

Tax Collector S Office Town Of Strafford Nh

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Road And Bridge Postings Status Reports

New Hampshire S Property Taxes Among Highest In Country New Hampshire Thecentersquare Com